The latest research by, Astons, the international experts on real estate, residency and citizenship through investment has revealed the extent to which the current pandemic has hit London’s high-end market where property prices are concerned.

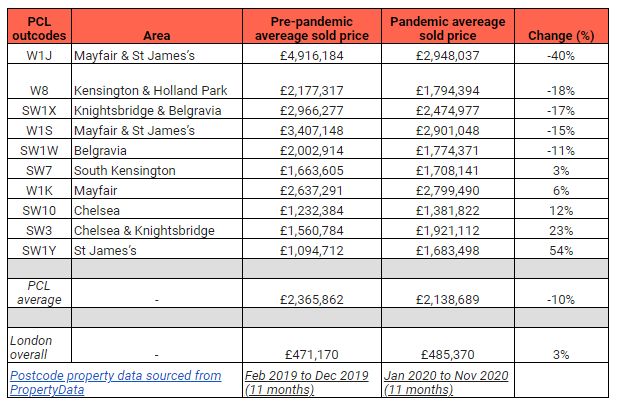

Aston’s analysed sold price records across the capital’s 10 most high-profile, prime property postcodes, comparing the average sold price secured since the start of the pandemic in January last year to the average sold price seen the previous year.

The research shows that despite the initial market instability caused by Covid, London house prices as a whole have crept up 3% during the pandemic.

However, while the overall market has seen prices climb, Aston’s research has found that on average, sold prices across prime central London postcodes have fallen by -10% since the start of the pandemic.

The W1J postcode in Mayfair and St James’s has been the worst hit with sold prices falling by -40% as a result of the pandemic, down from £4.9m to £2.9m.

Kensington’s W8 postcode has seen the second-largest decline falling -18%, with the SW1X (-17%), W1S (-15%) and SW1W (-11%) postcodes also seeing a double-digit price decline.

However, this property price rot hasn’t set in across the entire market and Aston’s research shows that while five postcodes have seen notable declines, five have also weathered the storm and registered positive growth.

The SW1Y postcode has seen the average sold price in the area climb by 54% during the pandemic, with Chelsea’s SW3 and SW10 postcodes also enjoying an uplift of 23% and 12% respectively.

The W1K (6%) and SW7 (3%) postcodes have also enjoyed an increase in pandemic sold prices.

Managing Director of Astons, Arthur Sarkisian, commented:

“The UK market has stood very firm in the face of Covid uncertainty and largely speaking, the market has accelerated since the reopening of the property market and the introduction of a stamp duty holiday. Unfortunately, this has not been the case in some of London’s most sought after high-end postcodes, with sold prices falling since the start of last year. This decline in property prices has been due to a number of factors. While nice, the stamp duty holiday saving hasn’t boosted buyer demand amongst high-end homebuyers to the same extent as it has in the regular market. Restrictions on travel have also prevented foreign investment to a certain extent while those looking to buy for themselves have continued to opt for more peripheral locations such as Hampstead. However, the silver lining is that prime London has arguably become more attractive as a result of lower property values, particularly to foreign investors. The current landscape not only offers a saving where property prices are concerned but also in terms of the soon to be implemented stamp duty increase for foreign buyers as of April this year. With much of prime central London holding its value and demand starting to return, it won’t be long before the current areas offering an attractive investment proposition start to see property prices climb once again.”

Leave A Comment